Master Trusts vs Wraps

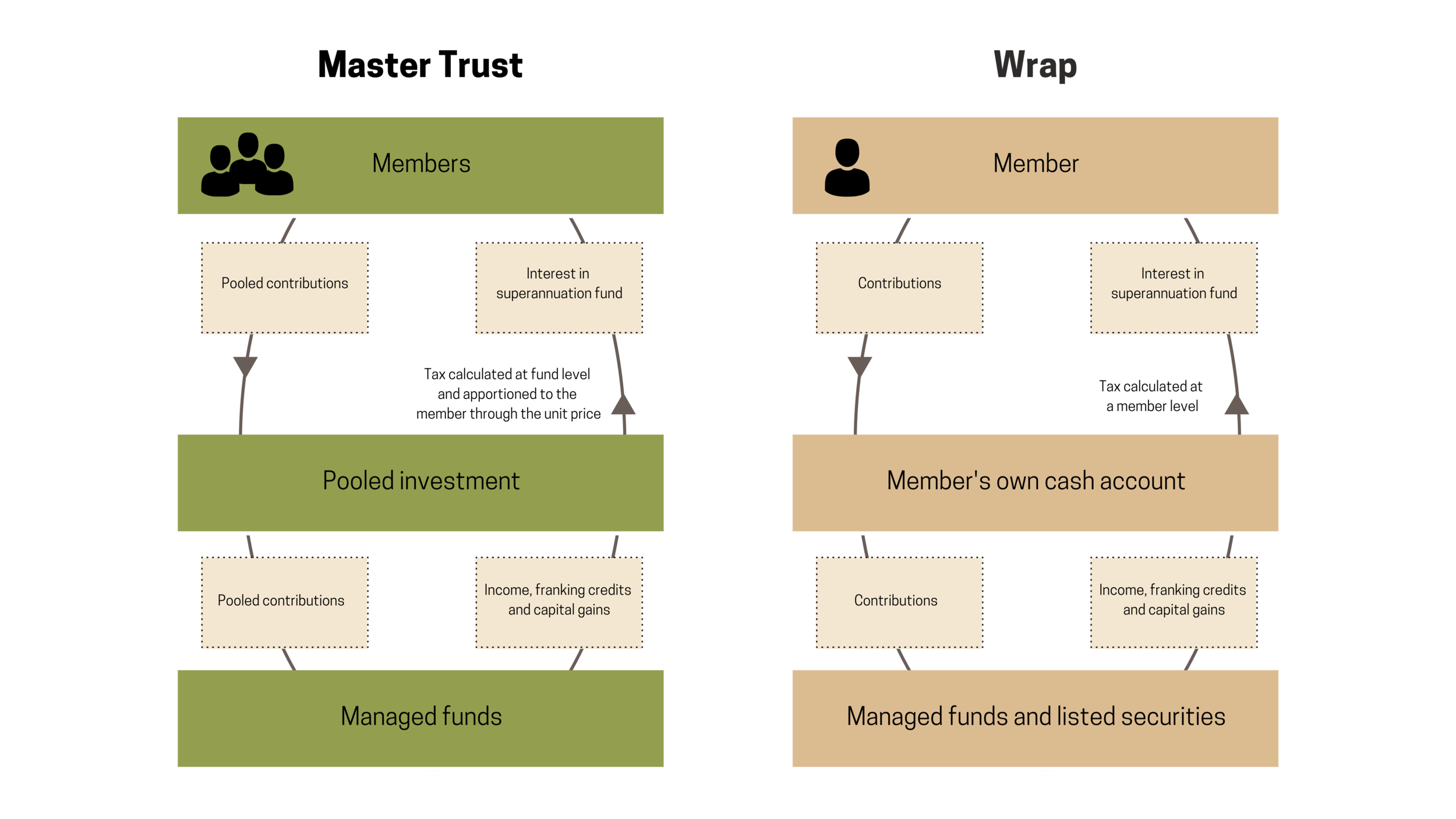

It can be confusing to understand the concepts of Master Trusts and Wraps in the superannuation context. Below is a general description of these concepts. Master Trusts and Wraps are both superannuation funds and must comply with the same rules and obligations. The key difference between the two is in their structure and, in particular, in the case of a Wrap, the broader availability of the investments and the use of a cash account as the central financing facility.

Master Trust

A Master Trust is a superannuation fund in which a large number of members deposit their money. The trustee of the Master Trust pools the money together and purchases interests in the underlying investments, typically managed funds.

The value of the investments of each member incorporates the fees, franking credits and some taxes from the underlying investments.

Wrap

A Wrap is a superannuation fund offering members access to a large number of investments including managed funds and listed securities. All transactions are made through a cash account, providing the member with full transparency.

Individual member’s tax credits and liabilities are unbundled from the value of their investments and members may benefit directly from the franking credits credited directly to the cash account.

Key Features of master trusts and wraps

As you can see there are benefits to each structure. Shape Financial is here to guide you through these decisions and will help you feel sure your superannuation is invested in the appropriate structure.